If your GTM isn’t working well, you can sense it.

Between not hitting revenue targets and the pit of your stomach doing somersaults, you know something’s wrong.

And you’re probably feeling one (or more) of these GTM Dysfunctions:

- Uncertainty about who to target.

- Doubts about the best channels to reach prospects.

- Sales pitches that fall flat, with low win rates to boot.

- Competitors leaving you in the dust.

- Prospects pushing back on pricing.

- Low product adoption rates.

- High (and unsustainable) customer churn.

So, what do you do when your GTM isn’t working?

If you’re like most startup leaders, you might not know where to start.

You’re probably feeling a ton of pressure from your leadership (and investors) to figure it out ASAP, but you can’t pinpoint the issue(s).

Before you jump feet-first into solutioning, you’ll want to avoid these common mistakes:

1) Doubling Down

When you’re faced with a lack of information, it’s natural to want to work harder to get the results you want. But what got you here isn’t working, so avoid putting in even more effort into strategies and tactics that aren’t delivering.

2) Random Acts of Marketing (RAOM)

This is a classic response to GTM not working as expected. A ton of pressure and unsolicited ideas from stakeholders around the org, typically from Sales, C-Suite, and Marketing, with suggestions on what new initiative or tactic to execute. Don’t fall into the trap of executing RAOM to appease leadership and stakeholders. Figure out what’s not working before trying new things.

3) Spot Checking

When things go wrong, leadership and stakeholders tend to have gut feelings about why. You’ll feel a ton of pressure to just “check this one thing” or “review this data,” etc. Rather than wasting time guessing blindly or finding only some of the culprits for ineffective GTM strategy and execution, use a GTM Audit to take a structured approach.

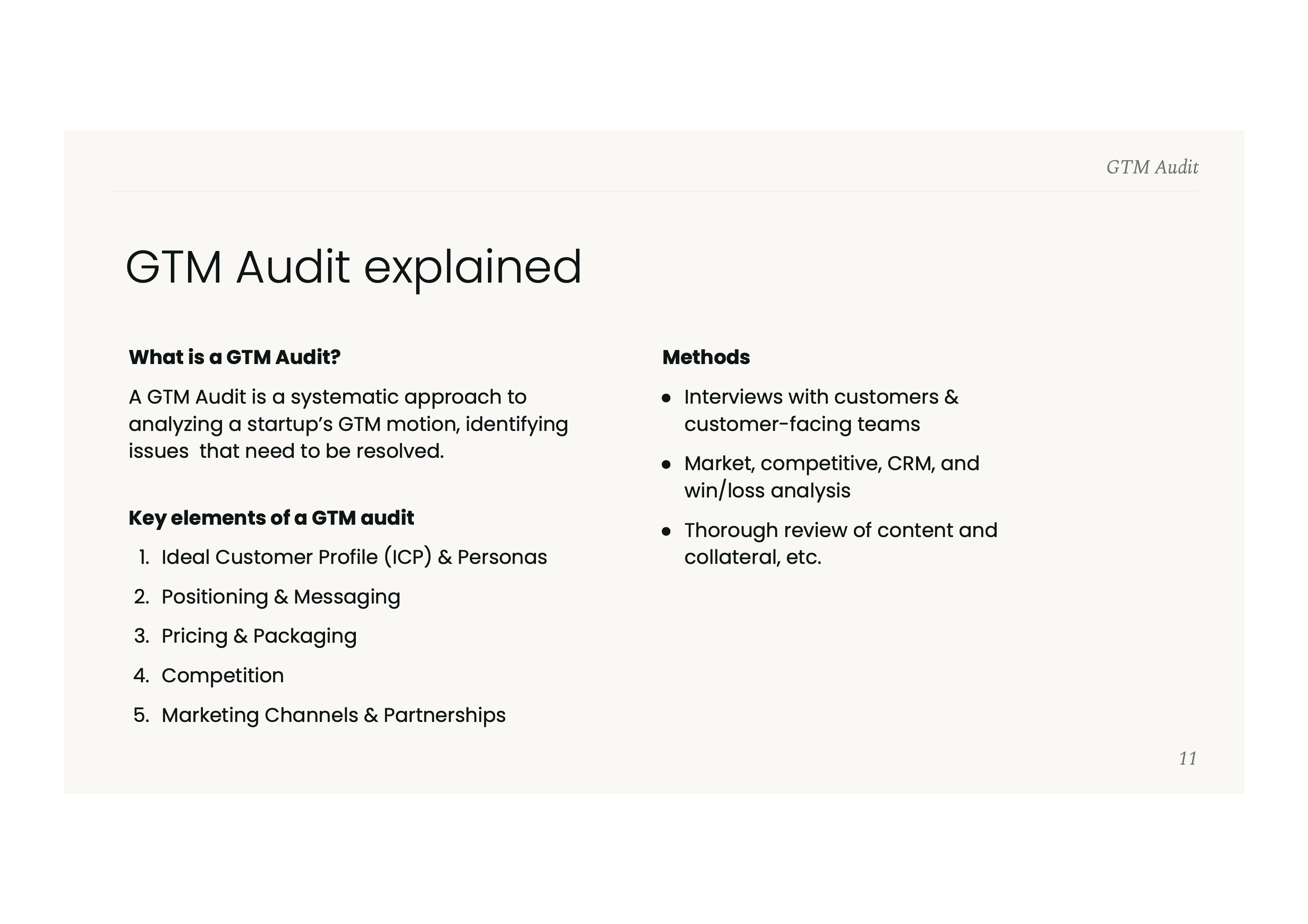

Time to audit your GTM motion

The best way to figure out what’s going wrong is to conduct a GTM Audit.

If you do it right, you’ll feel like a mechanic examining an engine to diagnose the issue(s) and get it going again.

Similarly, a PMM conducts a GTM audit to examine a startup’s GTM motion, helping to identify and resolve issues. Using this systematic approach helps you isolate the issues faster and understand their true impact across your company.

Key elements of a GTM audit

I recommend focusing on five key GTM elements in your audit:

- Ideal customer profile (ICP) and personas.

- Positioning and messaging.

- Pricing and packaging.

- Competition.

- Marketing channels and partnerships.

In the next few pages, we’ll dive into how to diagnose GTM issues and what methods you can use to analyze them.

P.S. check out this GTM Audit template to make your life a bit easier!

1) ICP and personas

I’ve found it helpful to think about auditing in terms of specific areas you should evaluate (such as teams), and methods by which to conduct the analysis (such as CRM analysis).

Let’s start by taking a look at ICP and personas.

Many startups are adamant that they have their ICP and target personas defined, but when you look under the hood, theory doesn’t always match reality.

Marketing

I like to start by uncovering the company’s current understanding of their ICP and personas. In other words, what does their documentation say?

If there is no documented ICP or personas, that’s a red flag. It indicates the need to conduct customer research to understand who you’re targeting (and to document it).

If you do have documentation, compare it to reality by looking at the efforts of your Marketing Team, and seeing if they align with these personas and ICPs.

Here’s what to look for:

- Do the events that your startup sponsors, attends, and hosts attract your ICP and target personas?

- Does your advertising target the right companies?

- Is the content your team is producing resonating and attracting the right companies and personas?

- And finally, are the leads that your Marketing Team delivers aligned with the defined ICP and target personas?

Do your startup’s events, advertising, content, and leads all indicate that a different ICP and persona(s) are in fact a better match for your startup’s products or services? Look at the data to validate (or invalidate) whether this is the case, and keep this in mind as you continue the audit.

Sales

From a Sales perspective, it’s important to understand:

- How your ICP and personas impact the buying process;

- Whether you’re targeting the right ICP/personas; and

- If you’re reaching them quickly.

Understanding who the Sales Team is speaking to and whether their results support reality is a good place to start.

Ask yourself these questions:

- Are the key members of the buying committee included in your target personas?

If not, do you need to add them? And are there any personas documented that the sales team truly never encounters?

- Is your win rate higher for ICP vs. non-ICP opportunities?

If it’s not higher for your ICP, does that mean you have the wrong ICP? Check the data to see which type of companies close the most.

- Are SDRs having success with outreach to your target ICP/personas?

Look for the bright spots. Where is success concentrated? Does that match what you’d expect? If not, perhaps your ICP and target personas need to change.

- Are you reaching prospects quickly? (This means in under 24 hours and, ideally, within a couple of hours.)

If not, you’re negatively impacting your ability to close these opportunities.

Customer success

After the initial sale is over and the prospect becomes a customer, do they still fit your target audience? If so, you’d expect them to have high adoption rates, usage, cross-sells/upsells and renewals.

Does your ICP:

- Adopt the product faster than non-ICP customers?

- Have higher NPS & CSAT scores than non-ICP customers?

- Have lower churn and higher renewal/upsell/ACV than non-ICP?

- Do buyers, users, and implementers line up with your target personas?

If the answer to any of these questions is “No”, this is an indication that you should:

- Identify what group is actually meeting these criteria (what group has the highest adoption?), and

- Look back at the Marketing and Sales audits to identify whether there’s a theme or trend here.

If no group is meeting these criteria, then either there’s an onboarding/adoption problem (more likely to be the case), or your startup has attracted the wrong types of customers.

Methods

How do you go about auditing the areas we just walked through?

You can focus your efforts on a mix of quantitative and qualitative methods, including:

- CRM analysis.

- Internal surveys and interviews with Onboarding, Product, Marketing, Sales, and Customer Success teams.

- Win/loss analysis.

- SDR outreach analysis.

Go-to-Market Motions Playbook

🚨 Warning: May cause disruptive demand for your products.

Think bringing a product to market is challenging?

Wait 'til you have to deal with the demand using the right Go-to-Market Motion will generate.

In this playbook:

- Discover the building blocks (motions) that’ll help you craft a successful Go-to-Market strategy wherever you’re working, whatever you’re selling. 🧱

- Stop struggling with the wrong methods. Start bringing your products to market in the way that’s right for your product and your org. ✅

- We unveil methods that’ll get your user base growing organically, as if on its own. 🌳

Are you ready to deal with the demand? 🫵

2) Positioning and messaging

Now that you’ve dug into who your startup is really targeting, it’s time to evaluate your positioning and messaging.

You’re going to both:

- Evaluate whether the documented positioning & messaging is being consistently used, and

- Identify whether it matches reality.

Marketing and sales

First things first: has your startup defined the value you deliver? Assuming the answer is “Yes”, ask yourself this:

- Is there internal alignment on how to talk about the product?

- Does the packaging and pricing strategy support the product narrative?

- Does the broader Marketing Team know where to access this documentation?

- Are products positioned consistently across sales collateral, marketing content, and web?

- Does the Sales Team have consistent pitches?

- What story do the most effective sellers at your company tell?

If there is internal alignment and positioning and messaging is consistent, then you can move on to evaluating whether it’s the most effective positioning and messaging.

Prospect and customer perceptions

The best way to test whether positioning and messaging is landing is to talk to customers and customer-facing teams.

The goal is to identify whether your existing positioning and messaging is working, or if there are more effective ways of explaining what your product does.

Here are a few high-level questions that you can explore with your customers and Sales and Customer Success teams.

- What space does the company occupy in the buyer's mind?

- Is positioning and messaging clear and differentiated?

- Does it resonate (and align) with prospects’ perceptions and experiences?

Methods

To audit your positioning and messaging, I’d recommend:

- Evaluating positioning and messaging and how they appear across your startup’s pitch deck, sales collateral, website, and SDR outreach.

- Holding internal interviews with Product, Sales, Marketing, Customer Success, etc.

- Analysis of 10-15 sales call recordings and 10-15 CSM renewal/churn calls.

- Win/loss analysis.

- Customer interviews.

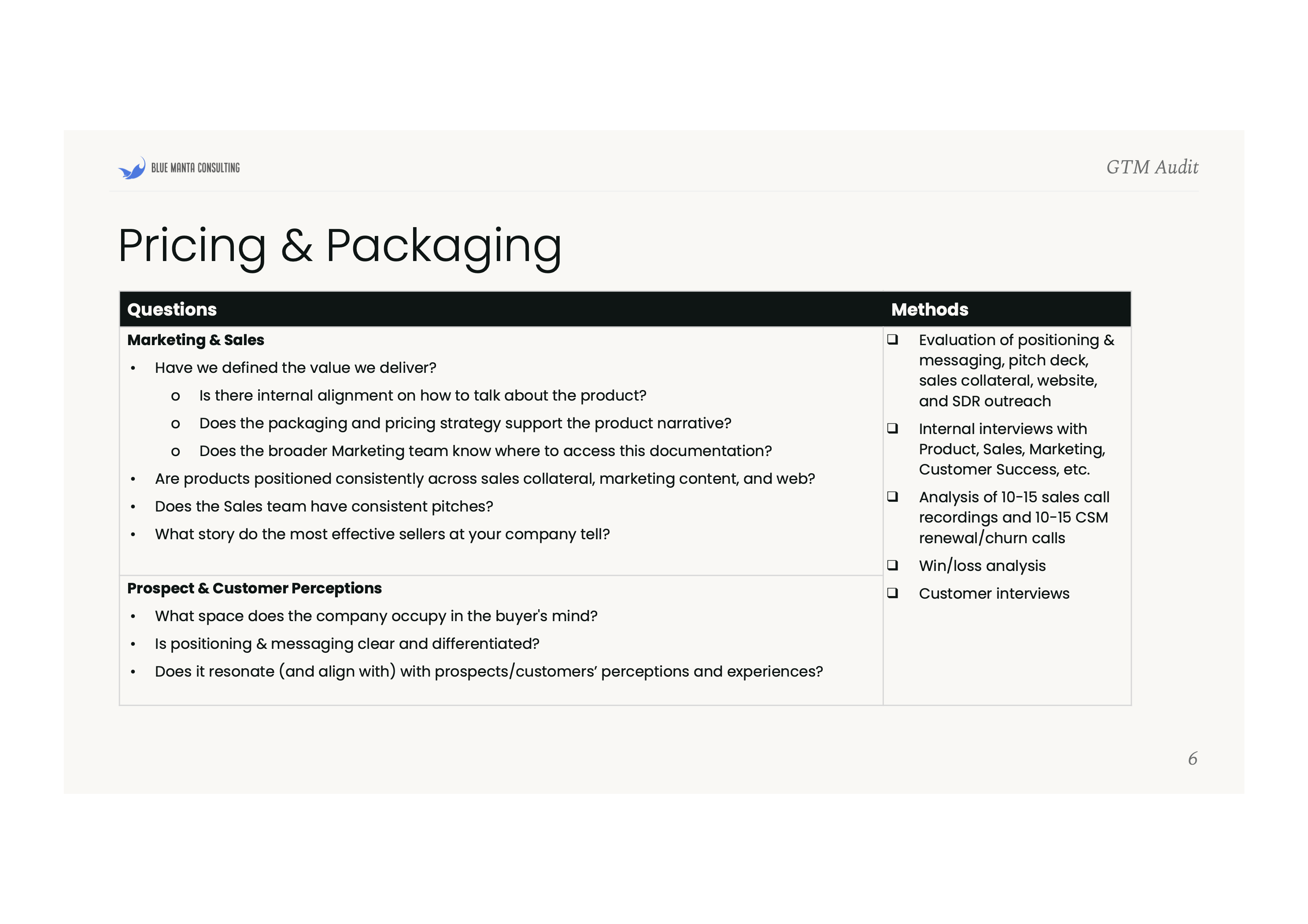

3) Pricing & Packaging

I tend to think of pricing and packaging as a distinct, yet integral part of positioning and messaging.

How can you separate the two?

Say you position your company as a premium brand, it wouldn’t make sense to offer rock bottom prices, right? Or if you present your startup as easy to do business with, it wouldn’t make sense to have over five tiers and 10 add-ons.

In addition to aligning with your positioning and messaging, your pricing and packaging should also consider the broader context of your market and competition.

Let’s dig into these now.

Internal alignment

Just like with positioning & messaging, I like to start by understanding whether prices, packages, and discounts are documented, and if there’s internal alignment. I also recommend digging into whether value correlates as expected.

- Is there one source of truth for pricing and packaging, and internal alignment on discounting?

- Does the pricing model match your positioning? (For example, a simple pricing model suits a company that positions itself as easy to do business with.)

- Do key stakeholders have the same understanding of the company’s pricing and packaging?

Perception

Assuming there’s internal alignment, the next step is to interview both customers and customer-facing teams to understand prospects/customers’ perceptions of your product’s value.

Conduct win/loss analysis by evaluating CRM data and talking to prospects. If you’re lucky enough to have analysts cover the space, check their reports to see how they compare your solution with your competitors’. You can also explore forums like Reddit or industry groups in Slack/Discord to see what people are saying about your company.

- Does the chosen value metric truly correlate with value?

- Does the pricing strategy match quality perceptions among prospects, customers, and Sales?

- How does pricing compare to the competition? Does it align with the value delivered?

Churn and renewals

When it comes to renewal and churn, you want to identify whether there’s a solid process in place and whether pricing is a major factor in churn.

- Is there a standardized process for renewals that includes automated renewals at X% price increase?

- Is price cited as the sole (or major) factor in >15% of churn reasons?

Methods

You’ll start to notice overlap in the methods used across different sections. Before diving into this process, it’s helpful to determine what questions you want to answer. Then, identify the methods you’ll use to get those answers. Plan accordingly so you ask the right questions during each method and don’t have to repeat them multiple times.

- Competitive analysis.

- Internal interviews with Product, Sales, Marketing, Customer Success, etc.

- Analysis of 10-15 sales call recordings and 10-15 CSM renewal/churn calls.

- Win/loss analysis.

- Churn analysis.

- Customer interviews.

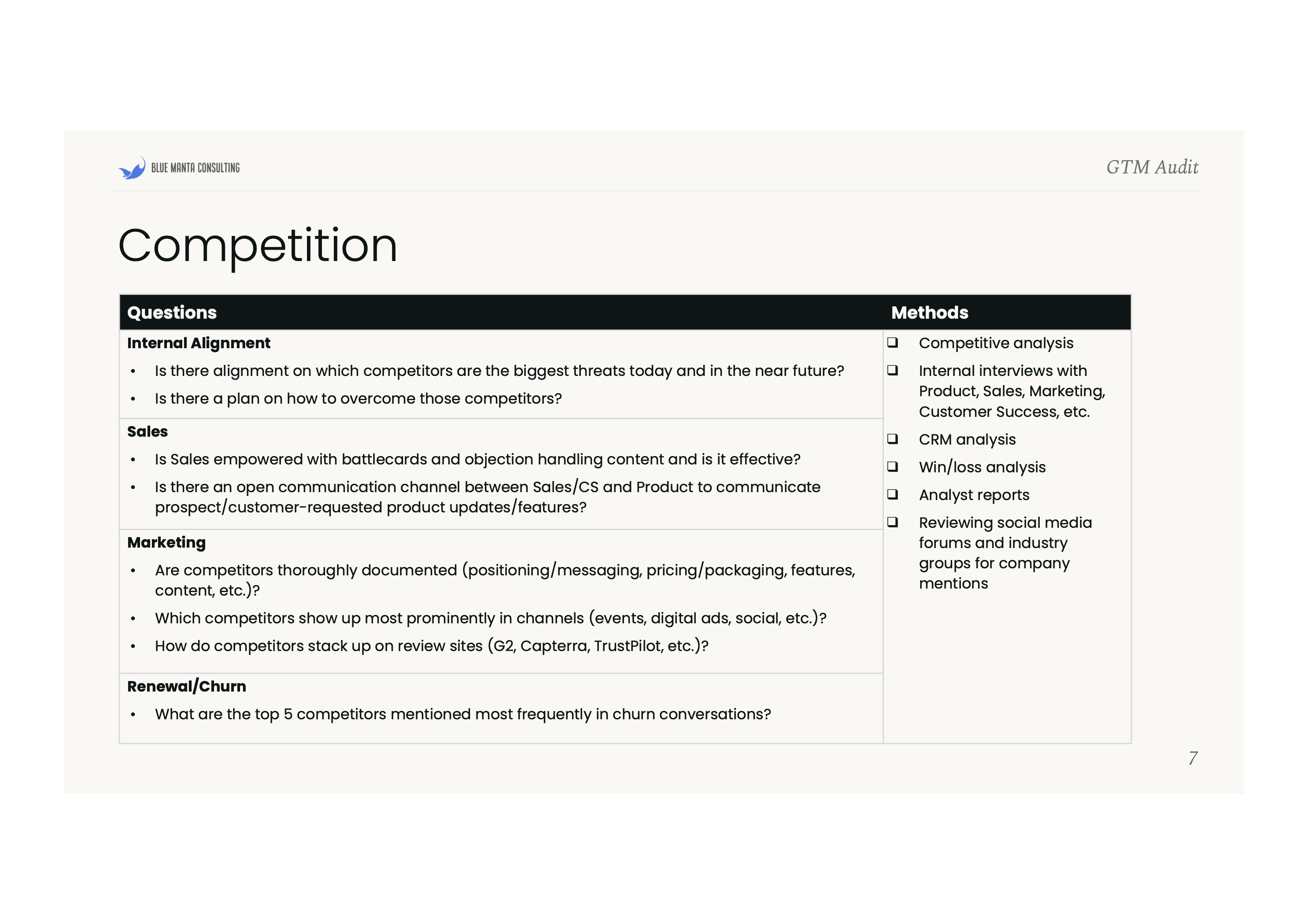

4) Competition

Competition plays a major role in both positioning and messaging, and pricing and packaging. So, while it may be fourth, it’s really part of the previous two sections as well.

When it comes to competitors, consider evaluating whether there’s internal alignment on which competitors pose the greatest threat (today and in the future), along with whether there’s an effective method to mitigate those competitors, and if there’s open communication between internal teams on competitors.

In a perfect world, internal teams won’t just communicate, they’ll align the entire GTM motion around competitor knowledge. From what the Product Team is building, to how the PMM Team is positioning & messaging, to how Sales is handling objections, all this will revolve around a centralized understanding of the competitive landscape.

Internal alignment

- Is there alignment on which competitors are the biggest threats today and in the near future?

- Is there a plan to overcome those competitors?

Sales

- Is Sales empowered with battlecards and objection handling content, and is it effective?

- Is there an open communication channel between Sales/CS/Product to communicate prospect/customer-requested product updates/features?

Marketing

- Are competitors thoroughly documented (positioning/messaging, pricing/packaging, features, content, etc.)?

- Which competitors show up most prominently in specific channels (events, digital ads, social, etc.)?

- How do competitors stack up on review sites (G2, Capterra, TrustPilot, etc.)?

Renewal and churn

- What are the top 5 competitors mentioned most frequently in churn conversations?

Methods

For understanding the competitive environment, here are a few places to start:

- Competitive analysis.

- Internal interviews with Product, Sales, Marketing, Customer Success, etc.

- CRM analysis.

- Win/loss analysis.

- Analyst reports.

- Reviewing social media forums and industry groups for company mentions.

5) Marketing Channels & Partnerships

Now that you’ve audited who you’re targeting, what you’re telling (and selling to) them, and how to stand out from competitors, it’s time to investigate how you’re reaching them.

Now don’t get me wrong, I’m not advocating for PMMs to be growth marketers. But I do believe PMMs are the best suited to determine what channels customers are using and what partnerships and communities would be strategic avenues for expansion.

I subscribe to the philosophy that capturing attention via ads is becoming increasingly out of reach for most startups due to expense and competition. As a result, I’m unequivocally putting my eggs in the partnerships and community basket.

Check out the GTM Partner-Led Growth Playbook (page 22) for more details.

Internal alignment

The first place I like to dig in is the difference between perception and reality – specifically whether the top lead sources match what internal teams (Sales and Marketing) believe.

One critical discrepancy to watch out for is this: Sales loves a lead source because it delivers a ton of leads, but Marketing is not a fan because those leads take way too long to convert from time acquired to close.

When auditing, ask yourself:

- Which marketing channels/partnerships deliver the most qualified leads?

- Which channels/partnerships deliver qualified leads that close the fastest?

- And does that alignment = doubling down on that investment?

Sales

If you have a ton of partnerships (think more than five) with distributors, other companies, industry groups, etc., it can be tough to juggle them all. And sometimes that means Sales isn’t familiar with all of them, or the personalized offers are lost in the wind. It’s helpful to talk to the team and figure out whether the team has what they need to keep it all straight and to communicate with these partners.

- Is Sales familiar with key partners and how their communities, technologies, distribution work?

- Is there clear communication and coordination with these partners?

Marketing

One thing I’ve learned over the past decade is that the grass is in fact sometimes greener on the other side. If a lead source isn’t performing, chances are, it can be replaced with a better alternative.

First, you’ll want to understand whether the team has spoken to customers and prospects to determine where you can reach your target personas. Whether that’s social media sites like LinkedIn and Reddit, industry-specific media sites such as Hacker News, or communities such as Go-to-Market Alliance or Fractionals United.

Figure out where your customers already live and try to partner with those companies and communities to deliver value to them. You can deliver value by creating free content such as guides, frameworks, reports, and by hosting webinars to discuss best practices. Or, bring in noted industry thought leaders to share the latest trends.

Make sure you consider the following:

- Has customer research been conducted to identify:

- How target personas learn? Where they go for information and referrals?

- What events they attend, communities/groups they’re in, and the influencers they trust?

- Which channels and partnerships deliver the most qualified leads?

- Is there clear communication and coordination with these partners?

- Are there opportunities for new partnerships/channels that haven’t been explored?

Methods

In addition to customer interviews, it’s helpful to truly learn the industry to understand where your customers hang out. For example, in the IT Service Provider space, many of them congregate on Reddit.

It’s helpful to check out their Subreddit and look for not only the type of content they’re sharing, but what sites and communities they mention. That’s a great way to quickly identify potential partnerships.

Use the following methods to achieve this:

- Customer interviews.

- Internal interviews with Product, Sales, Marketing, Customer Success, etc.

- CRM analysis.

- Industry analysis.

- Social media analysis.

What's next?

Congratulations, you’ve completed the audit! But what’s next?

Great question.

Now, it’s time to share the results of your audit with key stakeholders across the organization. That GTM Audit template includes a presentation section at the end.

Here’s the process I’d recommend.

- Compile your in-depth findings for each section of the GTM Audit. Make them easy to understand and share. Prioritize your recommendations, including estimated timelines, and identify proposed leaders for each.

- Present your findings individually to key leaders before you present the findings to the broader group. For most startups, that would be the CEO, CPO, CMO, and CRO, and one level down. Treat these like “sneak peeks.”

- Present your findings to the broader Leadership Team and get buy-in to take action to remedy the areas that need it.

- Start the work!

Get these fundamentals right, and you’ll be well on your way to fixing your startup’s GTM motion.